Equator Tutorial

Introduction:

Equator is a universal liquidity protocol based on BSC, using which custom pools can be built flexibly to complete any exchange between BEP20 assets. Unlike other Automated Market Makers (AMMs), Equator allows custom asset pools with more than 2 weights of 50/50. The following is a brief description of the use of Equator.finance.

Tutorial:

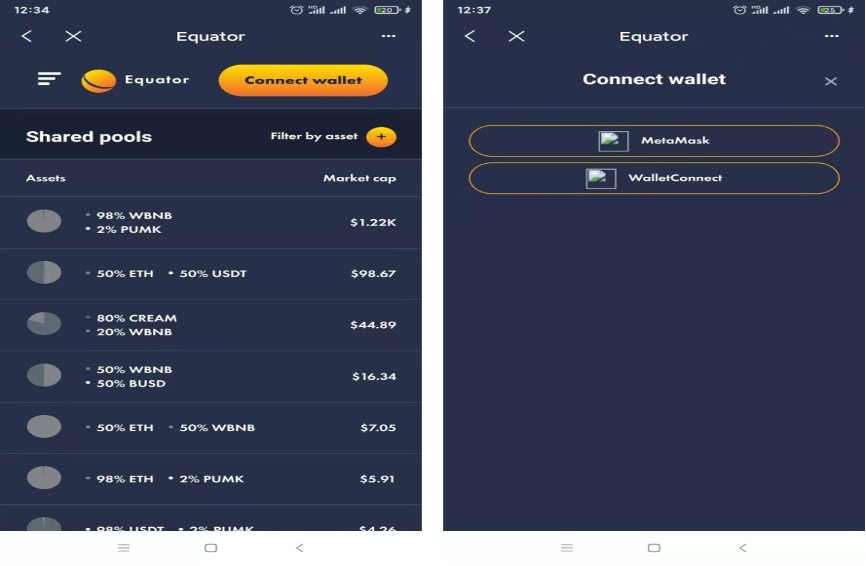

1. Users need to use the wallet based on BSC in TokenPocket Wallet to click 【Discover】to enter Equator on the top of search bar.

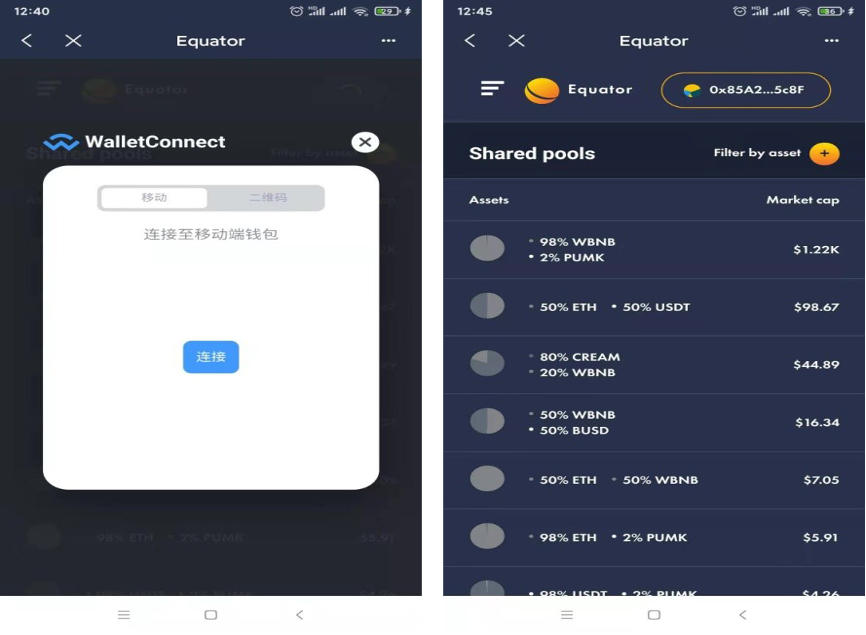

2. In the home page, users need use the yellow button to connect their wallets. Once users have successfully connected, return to the main screen and are able to see your wallet address in the top right corner.

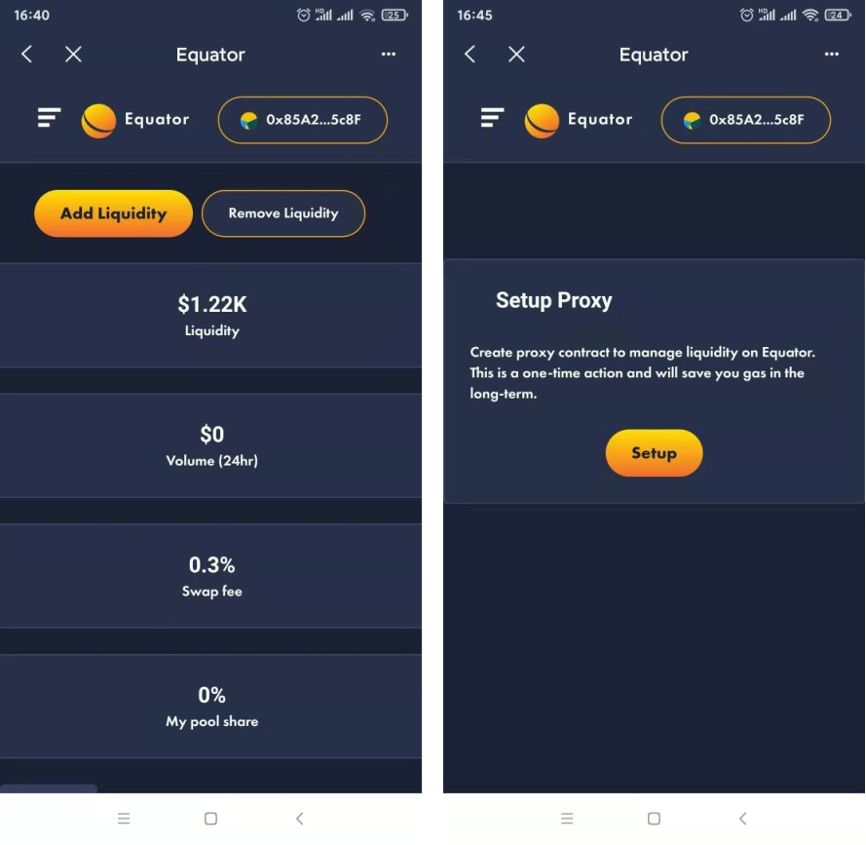

3. The main screen ranks assets by market capitalisation, click on the pair you are interested in, here is an example of the WBNB/PUMK pair. Click on the 【Add Liquidity】 button at the top of the screen to add liquidity, then click on 【Setup】in the pop-up window. Click on 【Setup】in the pop-up window, then fill in the quantity and confirm authorisation to complete the liquidity addition. Click 【Remove Liquidity】 to exit the liquidity pool.

This tutorial is only for the DApp in the wallet side of the operation guide, does not represent the investment advice of TokenPocket. Investing involves risks, you should be fully aware of the risks and make your own investment decisions.

Last updated